After touching record highs last Thursday, the market has had a tough time staying positive. This morning, stocks opened higher amid newfound U.S./China trade war optimism. By midday, it mostly faded as stocks retraced their early gains.

Still, though, plenty of beleaguered companies are enjoying a slight recovery. Take Hanesbrands Inc (NYSE: HBI), for example, which is finally rising after dropping almost 10% over the last six trading sessions.

Others, like Hewlett Packard Enterprises (NYSE: HPE), have only fallen further.

For those of you that don’t remember, HPE is a stock we featured just last week. It was giving us signs of a short setup that, at the time, seemed like a no-brainer.

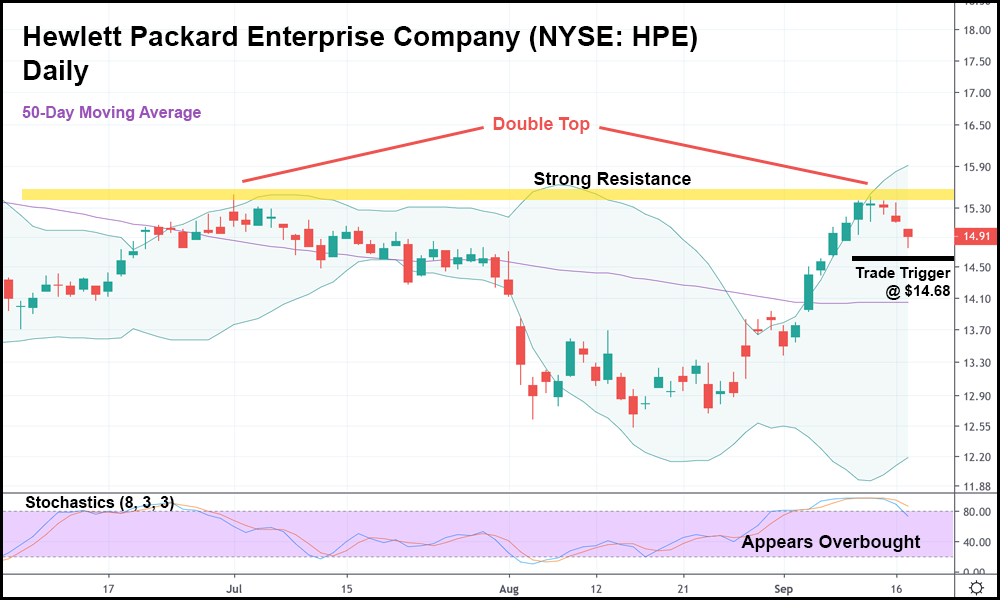

In the daily candlestick chart from last week, you can see where we ended up going short (at $14.68). Just a day after we looked at HPE, it moved past the trade trigger.

And since then, HPE has dropped a little over 3%. An appropriately priced October put would’ve returned approximately 30% – something that any trader would gladly take.

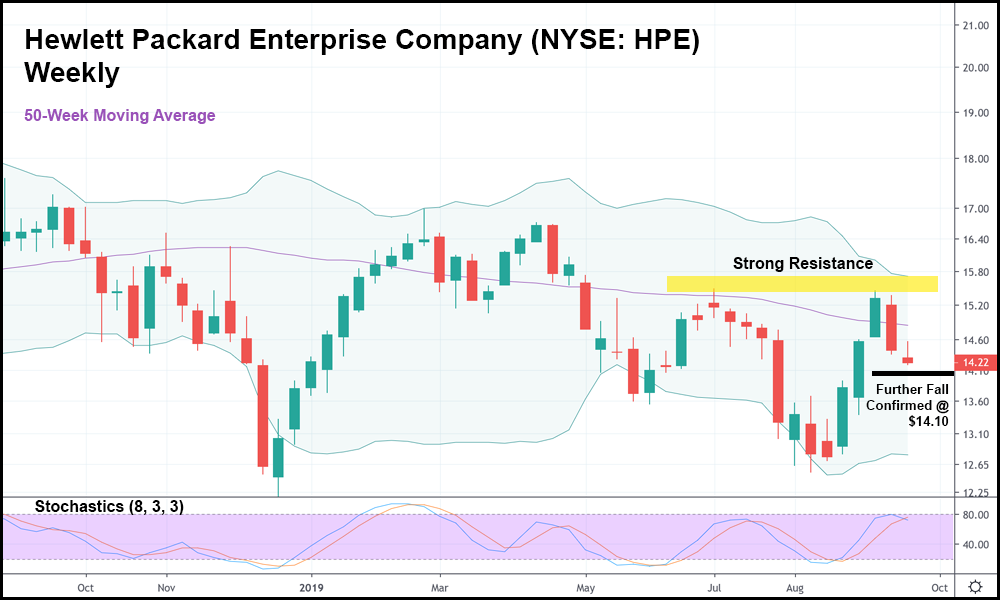

But thankfully, according to what the weekly candlesticks are showing us, HPE could be ready to fall even more.

Because HPE’s current weekly candlestick is trading below the last two AND the 50-week moving average is falling, it would make sense to take it short from a weekly standpoint should HPE fall below the low of the current week – whatever that is when the candlestick closes on Friday.

But for our purposes, since we’re already short on HPE from a daily standpoint, a move to our weekly trigger of $14.10 would confirm that this stock has some serious downwards potential in a longer-term move.

And to a trader that already has a short position on HPE, that’s great news. Alternatively, it’s a sign that bears who missed the daily trade might still have a shot at a trade.

Even though we’ve moved well past the daily trade trigger.

Now, that’s not to say that the weekly short setup is a “guarantee” of a downwards move. When it comes to investing – especially short-term trading – there are no guarantees.

But it certainly suggests that HPE could be ready for a downtrend that lasts several weeks, if not a month or more.

So, in this case, it might make sense to monitor this trade from a weekly candlestick viewpoint, not a daily one.

Provided, of course, that HPE ends up taking out this week’s current low, moving past our trade trigger of $14.10.