After having a great August, consumer discretionary stocks are starting to lose steam. September’s consumer confidence index (released just two days ago) fell sharply relative to last month’s numbers.

As a result, the entire sector is hurting.

But one company in particular – Target Corporation (NYSE: TGT) – could have an especially tough October in store if their share prices drop any further.

Because when TGT rose mightily in late August, retail bulls may have gone way too far, overbuying shares significantly.

And now, thanks to the buying-frenzy, a correction could be looming in the not-too-distant future.

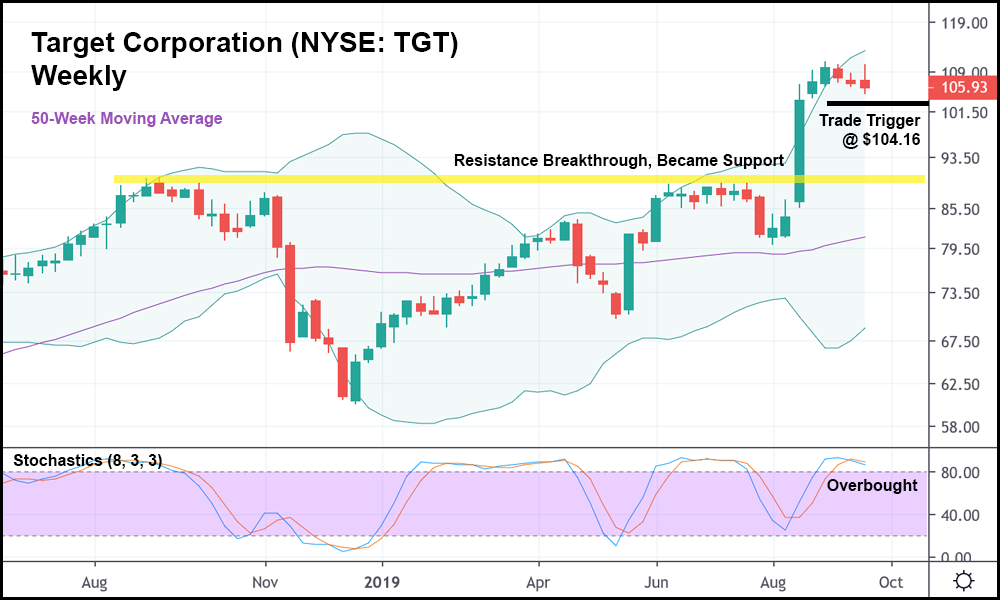

In the weekly candlestick chart above, you can see just how well TGT has done in 2019. Just a few weeks ago, share prices skyrocketed by over 23%, sending the stock well outside of its normal trading range.

And though bulls may be disappointed to see that the run could be ending, it’s created a huge opportunity for traders to go short.

Now, I know what you’re thinking:

“Why would anyone short a stock in an uptrend?”

Usually, I’d stay away from shorting a stock that’s trending upwards. But in TGT’s case, it had a recent breakout past resistance (the big green candlestick from six weeks ago), turning that resistance into support.

If TGT falls from here – something the price action suggests will happen – it could very well drop to that support at around $90.40, before bouncing back upwards.

From there, a higher low will have been set, and TGT could continue heading north. But should TGT to $90.40, that would be a drop of 13.2% below our trade trigger of $104.16, which is more than enough to generate a handsome profit.

Especially if we shorted TGT via an appropriately priced November put.

And even if TGT doesn’t make it that far, we could still have a great trade on our hands. Typically, I’ve found that following a huge candlestick (like TGT just had), the stock will often retrace its movement to about halfway up (or down, in this case) the wide-ranged bar.

The midway point for TGT’s big candlestick is at roughly $95.00 – that’s still a drop of 8.8% past our trade trigger.

Which, again, would produce some nice gains.

So, even though TGT may be locked into a solid uptrend at the moment, that doesn’t mean there won’t be opportunities to take it short. We’ve found one today, and after its next “spike,” I wouldn’t be surprised if we uncovered another.