Bears have been calling for a market-wide crunch for weeks now. Back in early December, they claimed that a correction was right around the corner. The major indexes all sunk on what investors initially thought was bad trade war news.

Instead, the rumors were just that – rumors – and on December 12th, a “phase one” trade deal was confirmed.

And though it may not have been the trade deal we were all hoping for, it managed to prevent a new set of tariffs from going into effect on the 15th.

The market, unsurprisingly, roared in approval.

And now, after having continued their bullish trend, stocks are continuing their slow climb to the top.

However, U.S. equities aren’t the only asset rising; treasury bonds are starting to get in on the fun, too, after selling-off significantly since September.

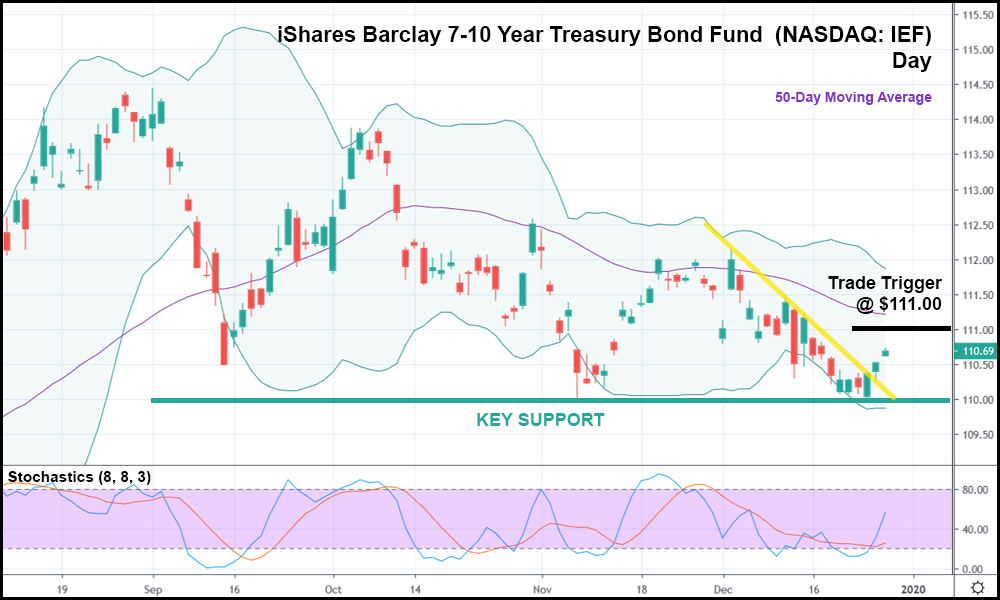

In the daily candlestick chart above, you can see that the iShares Barclay 7-10 Year Treasury Bond Fund (NASDAQ: IEF) – which tracks the performance of 7-10 year U.S. treasury bonds, as its name suggests – just bounced off support.

Back in early November, when support was set at roughly $110.00, it looked like IEF was in danger of falling further from its September high.

Now, though, after breaking out past its current bearish trend (the yellow trendline), the bond fund is eying a bullish reversal.

The stochastic indicator remains below 80, suggesting that IEF isn’t overbought, and the most recent daily candlestick closed above the last six candlesticks. Contact with the lower Bollinger Band (BB) was made as well, suggesting that this bond fund has serious rebound potential.

The last time it made contact with the lower BB was when IEF set the key support level. From there, it rose 1.56% – a big move for IEF.

Now, it’s looking to do the same, but potentially even better.

Best of all, even the market keeps rising, IEF could shoot upwards as well. For most of 2019, IEF and the S&P 500 tracked each other’s movements. The correlation broke in September, but there’s no reason to believe that we won’t see a reconnection between the two.

Especially after a “phase one” trade deal has cooled tensions.

So, with 2020 approaching, watch for IEF’s movement over the next few days. If it rises above the most recent day’s high, it might make sense to go long with a trade trigger of $111.00. An appropriately priced and dated option could do very well here.

Regardless of the general market’s performance.