After getting roasted yesterday in a 1.46% drop, Nasdaq stocks are still hurting. Yes, the index is up slightly today, but that doesn’t change the fact that America’s tech firms have been wounded.

Some of them, like Enphase Energy (NASDAQ: ENPH), the stock I wanted to look at today, are selling off after attempting to mount a mid-September recovery.

And though it might be tempting to jump back into these stocks at “bargain” prices now that they’ve dropped, what’s coming next (for a few of them, at least) could result in an even more significant fall from their August highs.

Because with newfound impeachment worries and trade war pessimism giving rise to uncertainty in the market, growth-oriented stocks might be too dangerous to buy.

But that doesn’t mean we can’t still short them for impressive gains.

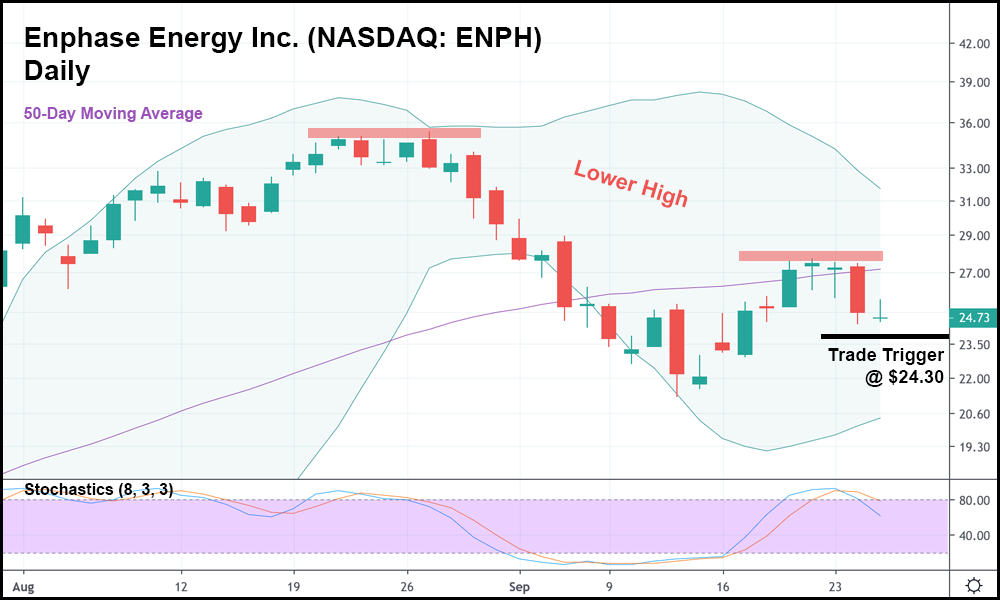

In the daily candlestick chart above, you can see that ENPH, a renewable energy technology company, just set a lower high. It’s not quite as good as a lower low, but it works for our purposes, since ENPH peaked in August after going on a tear since December 2018 (not pictured).

And while the stock has definitely fallen since August, it’s still got plenty of room to drop. The stochastics, though not ideal, are still in an acceptable range, suggesting that the stock isn’t oversold.

More importantly, though, is that the current candlestick is trading below the last 4. Should ENPH move below the low of the previous four candlesticks (yesterday’s low) by a significant amount, it might make sense to go short.

From there, our next obstacle sits at $21.23 – the closest point of key support.

If ENPH can generate enough momentum to break through support at that level, share prices could plummet. The next levels of support are by no means as strong as $21, meaning that ENPH could absolutely crater over the next month or two.

Of course, that will only happen if ENPH moves past our trade trigger AND key support. If ENPH reverses and heads upwards, taking it long slightly above the lower high (at around $27.86) might end up being the better move.

It all depends on ENPH’s price action for the rest of the week. Based on what the chart has given us, though, I’d say a drop – not another rally – is more likely.

However, it never hurts to be prepared for either scenario, which is something that successful traders routinely do. Whichever way ENPH goes, we’ll be ready.

So long as the stock trades deliberately, like it has for more than a year now.

Even in the middle of a trade war-obsessed market.