Earlier today, White House economic advisor Larry Kudlow said that a few “positive surprises” could arise from the trade talks between U.S. and China next week. Scheduled to meet in Washington, both sides of the trade war are looking to make amends.

In China, the economy worsens by the day. Stateside, President Trump wants to secure a 2020 re-election.

Ending the trade war on a positive note would significantly improve his chances.

“There could be positive surprises coming out of these talks,” said Kudlow in a Bloomberg TV interview.

“I’m not predicting. I’m just saying don’t rule that out. There could be some positive surprises.”

He continued, adding that, “coming into this, China has been buying some commodities. A small amount, but perhaps a good sign.”

Kudlow is referring to the recent soybean purchases made by Chinese buyers. Last week, they bought 1.5 million metric tons of U.S. soybeans. That’s almost enough to make soy lattes for the whole world.

However, he also warned that there’s still a sticking point (or two) that could cause a trade deal hang-up.

“I do know we continue to monitor the Hong Kong freedom and democracy movement, which the U.S. supports very strongly. That could impinge the talks.”

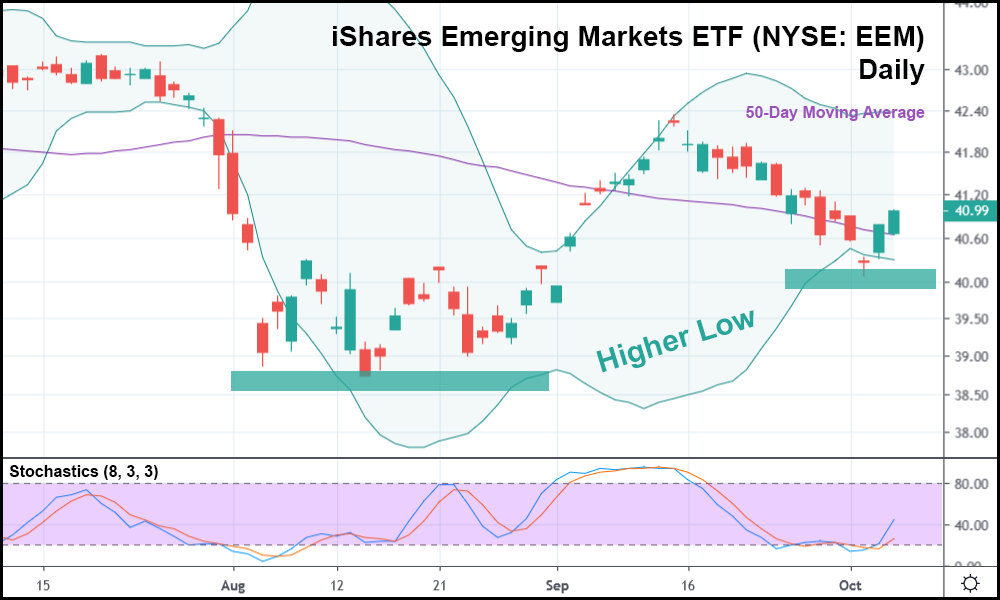

Regardless, investors took this as a sign that we may finally bear witness to a permanent trade war truce. The iShares Emerging Markets ETF (NYSE: EEM) is rising as a result.

It’s an ETF we featured last month, and it managed to generate some quick profits in just a matter of days.

And now, after setting a higher low, EEM appears ready to “take off” once again.

In the daily candlestick chart above, you can clearly see the aforementioned higher low, contact with the lower Bollinger Band (BB), and a 2-day winning streak that could easily extend into next week.

You might also notice that the stochastics are somewhat higher than normal. But it’s something that I’m willing to overlook in this case as the reading still lingers below 50 and everything else (BB contact, higher low) looks good.

Most importantly, though, is the most recent candlestick’s price action. The current daily candlestick is trading above the last four candle body highs, suggesting that EEM is truly “rounding the corner.” Should it keep trading higher, to around $41.20, it might make sense to go long.

The last time EEM ran into the lower BB, it chopped around before rising. This time, though, the circumstances are far better. The ETF is trading much more deliberately, suggesting that EEM is ready for a consolidated move.

Meaning that if things go well in Washington, bulls who took a shot on EEM early could end up with some serious “spoils of war.”

The trade war, that is.