After a few days of minor speculation, it’s official:

The Federal Reserve will leave rates unchanged – for the near future, at least.

After the Federal Open Market Committee’s (FOMC’s) meeting concluded today, Chairman Jerome Powell told reporters the news.

It’s the outcome that both analysts and investors expected. And much like interest rates, stocks didn’t move either. Had a “higher rate 2020” been announced, the market would’ve dropped.

But instead, Powell & Co. don’t see any rate hikes coming down the pipe. The U.S. economy is still doing well, unemployment is low, and inflation is in check.

In other words; there’s no reason to shake things up. Back in late 2018, the Fed did just that when it raised rates, causing equities to tip over in Q4.

It seems that the FOMC’s learned its lesson:

Keep rates low, keep investors happy. At this point, they don’t really have a choice, though. The U.S. government can’t let its $22 trillion national debt load get any more expensive.

So, a continued low rate environment is what we’ll get for the foreseeable future, pending any significant economic upheaval.

And if rates remain in stasis, companies should (theoretically) continue to grow. Stocks that have underperformed over the last few months might blossom as a result.

One in particular – Ford Motor Company (NYSE: F) – looks like it’s about to within the next couple of sessions.

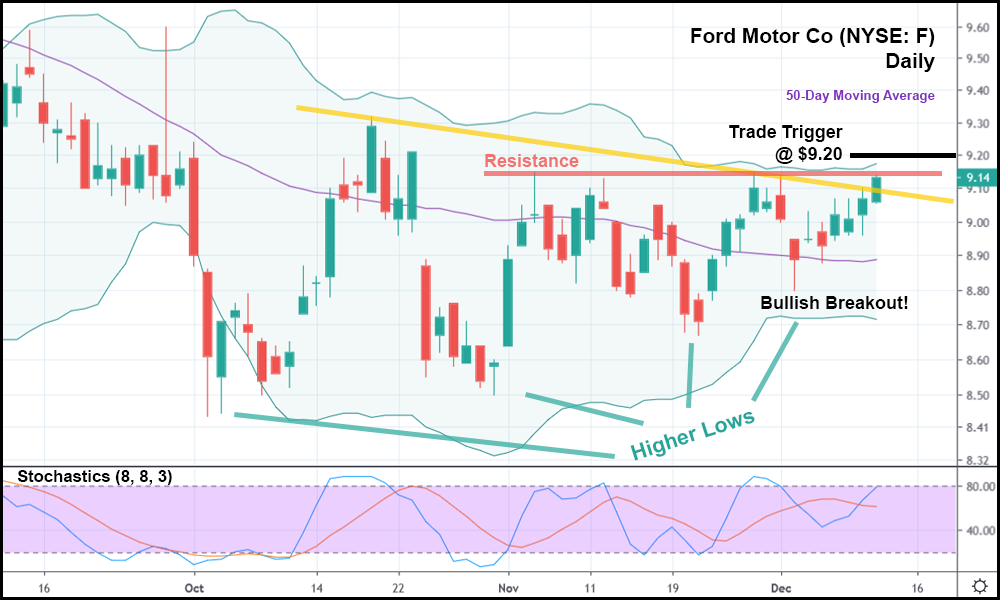

In the daily candlestick chart above, you can see that F has a lot going on. A minor trend breakout just occurred today, pushing share prices right up against resistance. The stock also set several higher lows, suggesting that an uptrend could start soon.

The stochastic indicator is a little high for my taste, but because of F’s unique situation – several higher lows, a minor trend breakout, and resistance nearby – it could easily “pop” upward, stuffing the stochastics well above 80 for a handful of sessions.

During which, F will continue rising.

The 50-day moving average is starting to head north as well. Combined, all of these variables could be a sign that F’s luck may finally be changing.

And because of that, it might make sense to go long on F slightly above the most recent candlestick’s high, at a trade trigger of $9.20. An appropriately priced and dated call option, should F truly break past resistance, could return fantastic gains in a short amount of time.

If F doesn’t continue its run, though, we could also have an opportunity to go short (likely next week) as part of a triangle breakout to the bottom.

But for now, the long position shows more promise. So, over the next few days, watch and see if F makes the leap to $9.20. A move past that point could mean big things for bulls, as the general market looks to set a new all-time high.