Despite its best efforts, the market just can’t seem to break new ground. Since setting a new all-time high in late November, equities have stagnated – dropping, rising, and chopping sideways.

It’s a sentiment-driven market, fueled by headlines. Investors got scared when President Trump hinted at a 2020 post-election trade deal.

Then, they were overjoyed to hear that negotiations between the U.S. and China were going well.

Better yet, last Friday, a mega-jobs report – which showed that 266,000 payrolls were added in November – reversed recession fears. Stocks roared in approval.

And now, with a December 15th tariff deadline quickly approaching, everyone’s getting nervous once again. The Wall Street Journal reported this morning that Trump was supposedly thinking about delaying tariffs – something that should’ve sent equities higher.

Instead, investors were skeptical. They’d been burned by unsubstantiated claims in the past.

This could simply be another one.

And so, while the American markets tread water, waiting to hear from President Trump himself, plenty of other trading opportunities are springing up. Some, in unlikely places.

Take, for example, the iShares MSCI South Korea ETF (NYSE: EWY), an ETF that seeks to track the performance of, you guessed it, South Korean equities.

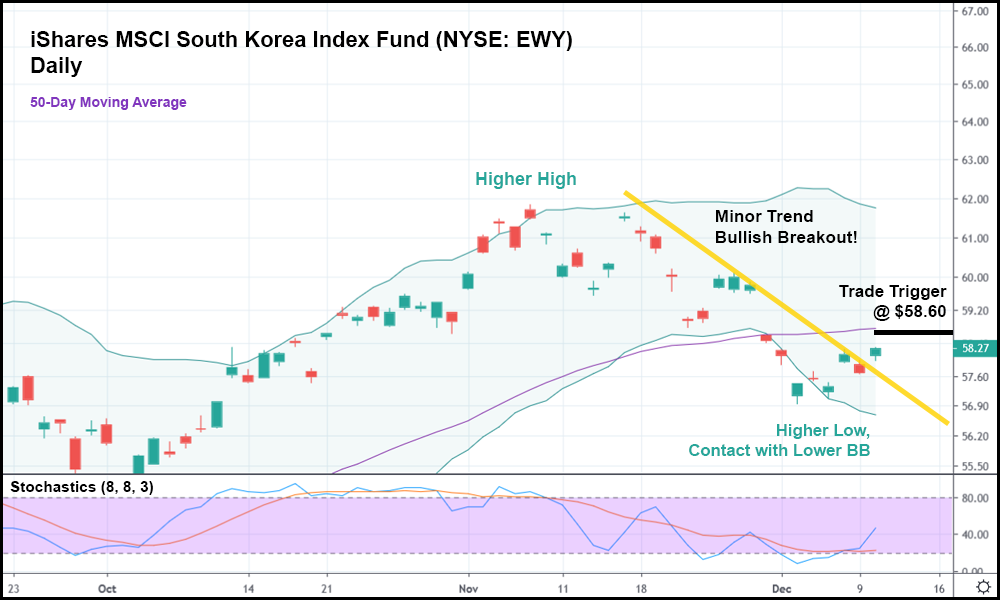

In the daily candlestick chat above, you can see that after rising throughout the entirety of October, EWY is now cooling off. Investors dumped the ETF after it flew too high above the upper Bollinger Band (BB), causing a minor bearish trend to form.

And after bouncing off the lower BB, EWY has locked in a bullish breakout past that bearish trendline. The 50-day moving average is pointed up (albeit slightly), and the stochastic indicator is low enough to suggest that EWY has more room to run.

Plus, there’s a higher low and a higher high relative to the last high and low from September (not pictured).

Should EWY rise slightly above the current day’s high, it might make sense to enter a long position via a trade trigger at $58.60. Right now, from our trigger price to the upper BB, there’s about 5% worth of gains.

ETFs move slower compared to stocks, so while that might not sound like a ton of space for EWY to rise, it’s more than enough to generate a decent profit with an appropriately priced and dated call option. In fact, a few weeks ago, investment banks began targeting South Korean ETFs as potential overachievers for 2020.

That alone has drawn significant interest to ETFs like EWY, meaning that once South Korean stocks start moving, they could really get a head of steam.

So, while investors bicker stateside on what’s going to happen with the trade war, keep an eye on EWY. Today’s minor trend breakout might be just what the doctor ordered for bulls, as conflicting headlines continue to muddle the American markets.