Poll numbers are in, and Elizabeth Warren is the current Democratic frontrunner. It’s got her supporters overjoyed – could she really unseat former Vice President Joe Biden, a once “shoe-in” nominee?

As of this afternoon, it certainly seems possible.

Wall Street, on the other hand, isn’t feeling all that excited. Even affluent Democrats are bemoaning a Warren nomination, many of whom have vowed to withhold campaign donations should she win the primary.

Because in addition to a set of controversial policies, Warren’s made an “anti-bank” approach part of her core platform. Over the last year, Warren’s disdain has extended to the entire financial services industry, including insurance companies.

With a potential Warren presidential run in 2020, investors – both big and small – are starting to get nervous, particularly when it comes to holding bank stocks. The sector as a whole got off to a hot start in 2019, but now, things are starting to cool.

If Warren keeps gaining momentum, bank stocks could go ice-cold over the next few weeks. Which, for bulls, is a troubling proposition.

But opportunistic traders who are willing to take a bear’s perspective (at least temporarily) will find that there’s still plenty of winning trades waiting to be discovered.

So long as they’re looking at the right stocks, like Genworth Financial (NYSE: GNW), an insurance company that’s headed for a significant correction.

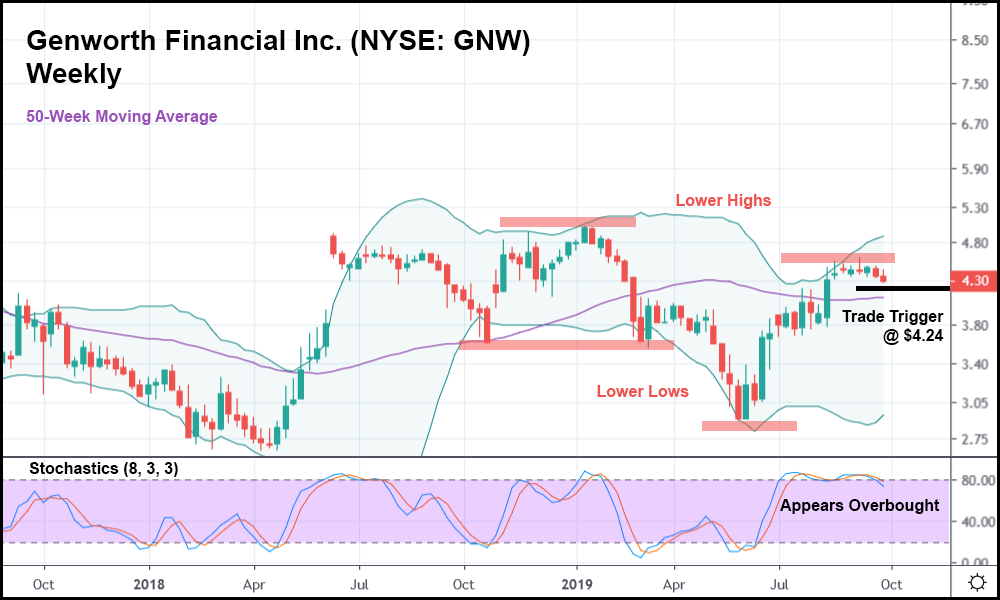

In the weekly candlestick chart above, you can see that GNW is locked in a slight downtrend. It’s made huge gains in 2019 but still managed to set a lower high just a few months ago.

Also, the lower low from May of this year tells us that GNW could quickly come screaming back downwards.

More importantly, though, is the price action of the last few weeks. With GNW trading below the last six candlesticks, we have plenty of evidence here that the stock’s prolonged rally could finally be over. There’s contact with the upper Bollinger Band (BB) as well, which further reinforces the idea that significant overhead pressure could be weighing GNW down.

Independent of any Elizabeth Warren-driven pessimism.

In this case, going short at our trade trigger of $4.24 (just below the current week’s low) might make sense. The stochastics are telling us that GNW remains overbought despite the recent selling, meaning that a bigger drop could very well be in store.

If that does happen, and GNW sets a lower low, we’d be looking at a gain of around 30% – something certainly worth celebrating.

Even if Warren’s newfound popularity ends up torpedoing the market further.