It’s gut-check time for the stock market. GM workers remain on strike, U.S. officials suspect that Iran was responsible for the Saudi oil attacks, and equities are stuck fast, waiting for something to re-energize bulls.

And halfway through today’s trading session, the indexes continue to tread water.

But while the general market lingers, a few select stocks have become break-out stars.

Instead of rising, though, these companies are enduring significant share selloffs, retracing gains made during the recent 3-day rally.

For current shareholders, that’s terrible news. But for opportunistic, short-term traders, the “big losers” on the day are presenting even bigger opportunities to go short.

Take Hewlett Packard Enterprise (NYSE: HPE), for example, a “computer stock” that could be primed to fall.

Born in 2015 when Hewlett-Packard split up, HPE got off to a great start – opening at $9.06 per share before topping-out at $19.48 in early 2018.

However, since then, it’s been mostly downhill. Yes, there were times where HPE attempted to recover, but the end result was always the same:

The setting of consecutive lower lows and downtrend continuations.

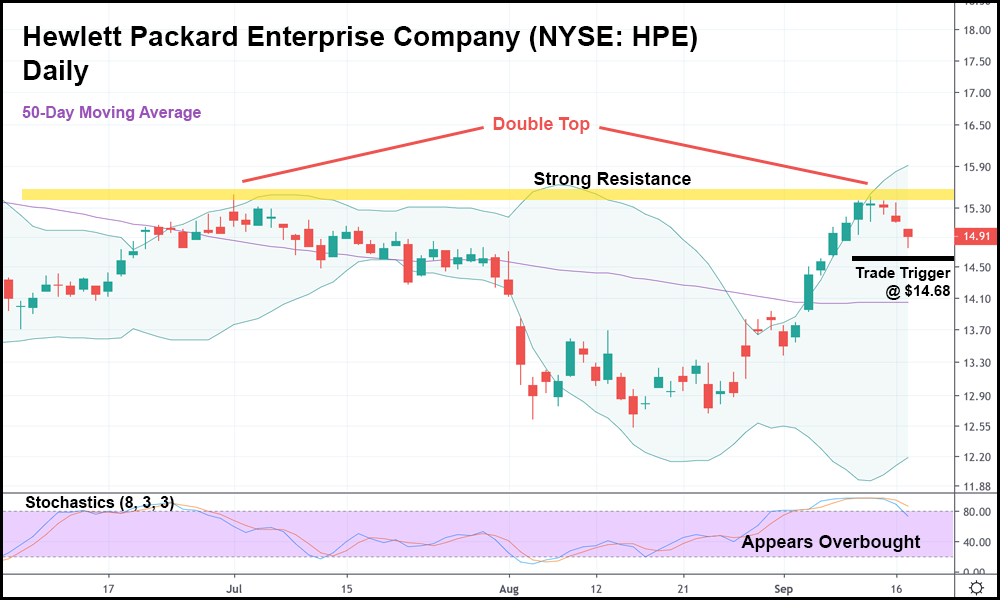

And as you can see in the daily candlestick chart above, it looks like history is about to repeat itself. HPE just made a clear double top, bouncing off resistance and the upper Bollinger Band (BB).

The 50-day moving average is flat, and the stochastics indicate that the stock remains overbought despite today’s selling.

But of course, all of that means nothing if we don’t have ample price action to back it up. Thankfully, HPE is trading below the last four candlesticks, which to me is a great sign that momentum is shifting downwards.

Add to that the fact that a lower low was set in August relative to June (not pictured), and you’ve got the makings of a wicked downtrend continuation.

Whether that happens or not, however, remains to be seen. If HPE drops below the low from today by a significant amount (to $14.68), a fall further would seem likely at that point.

And should HPE descend below the trigger point, I would be surprised at all to see the stock set another lower low, potentially in the $11-$12 range.

However, HPE could also just as easily set a double bottom, right before kicking out a trend-reversal.

In either scenario, though, traders who short HPE at our trigger price of $14.68 would end up pocketing massive windfall gains.

So, over the next few weeks, keep an eye on HPE. The market will end up returning to its winning ways eventually, but while there’s still turbulence, HPE could end up eating some impressive losses.

Which, of course, will provide bears even more impressive gains.