Remember, Nokia (NYSE: NOK), the once humble telecom firm? Known for the Nokia 3310, their September 2000 mobile phone (appropriately nicknamed “the brick”), the company quickly rose to prominence, supported by their best-selling phone.

Company share prices erupted as well, hitting an all-time high of $58.12 back in July of 2000.

Which, incidentally, happened right before the “Dot-com” bubble burst.

Two years later, NOK finally bottomed out, before making a massive recovery in 2007. Share prices went all the way up to $42.22 – a seven-year high – but eventually came crashing back down during the 2008 financial crisis.

And sadly, since then, NOK hasn’t really been the same. The company’s fought to stay nimble in a constantly shifting telecom landscape by making new ventures in related industries.

However, try as they might, getting pushed out of the market by other smartphone manufacturers has kept share prices down.

NOK isn’t too far off from its all-time low (post-IPO) as a result.

But, with the advent of 5G – a top-speed data network – NOK might finally be gearing up for a recovery, as the company has managed to insert itself as a 5G baseband supplier to Japan’s largest mobile operator (NTT DOCOMO).

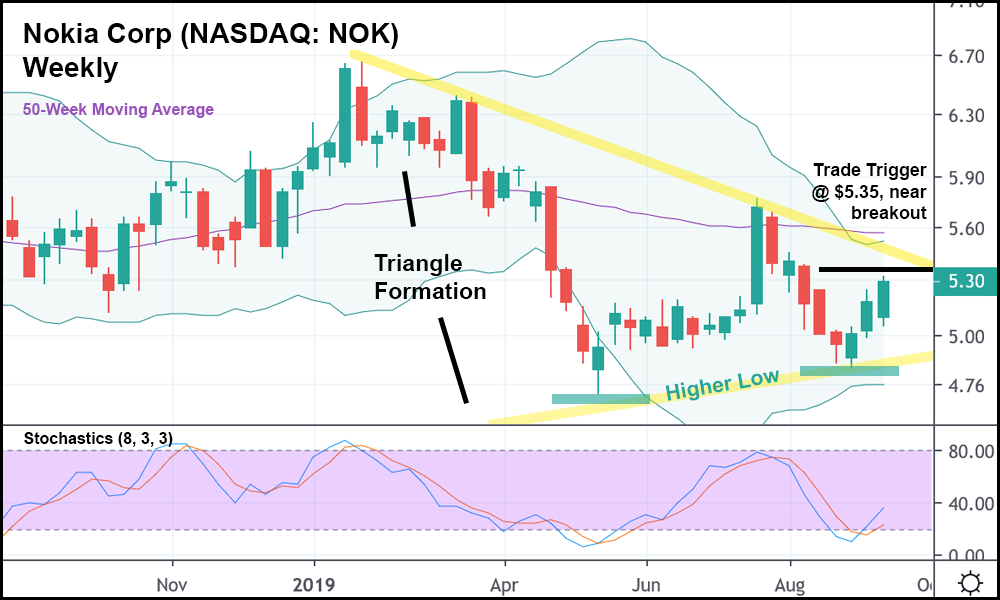

In the weekly candlestick chart above, you can see that sentiment is starting to shift for NOK. A higher low was set two weeks ago relative to the low of last May while consecutive lower highs were set, spanning all the way back to January.

Combined, those trendlines have created a triangle formation. Meaning that should NOK keep rising (like it’s doing now), a breakout to the upside past the upper trendline is on the table.

Of course, a breakout to the downside is also possible, but based on what NOK’s done over the last month, it appears as though an upwards move is more likely.

Especially since the current weekly candlestick is trading above the last three.

If NOK heads north of the current week’s high, entering a long position slightly above it might make sense (at $5.35).

Because from there, the upper trendline is just a short distance away.

And if NOK ascends beyond that? Look out, because bulls might start to pile-in as it becomes clear that the company is spearheading the 5G movement.

However, that only happens if the current week’s high gets “taken out” by NOK’s price action.

Which, based on what the chart is giving us, looks highly possible.

Even after the market’s surprise afternoon downturn from earlier today.