Stocks rocketed higher at the open this morning before reversing sharply through noon. The Dow, S&P, and Nasdaq Composite all gave up most of their returns as the short squeeze fizzled.

Treasury yields, on other hand, rose substantially. Treasurys didn’t rally significantly alongside stocks yesterday. Today, they fell.

And Treasurys typically move in tandem with equities. Heavy Treasury selling this morning dragged stocks down intraday.

We warned last week that a move above 4.0% for the 10-year Treasury yield could spark additional selling. If the 10-year yield remains above 4.0% much longer, things could get very hairy for bulls and fast.

But prior to the Treasury rout, stocks started the day on a bullish foot after Goldman Sachs (NYSE: GS) reported a major beat, following Bank of America’s (NYSE: BAC) surprise beat from yesterday.

David Solomon, CEO of Goldman Sachs, delivered a less-than-optimistic message in a CNBC interview, though. He said there’s a “good chance” a recession will soon arrive in the US.

“That environment heading into 2023 is one that you’ve got to be cautious and prepared for,” Solomon said

Analysts are still unsure of what to make of the current market conditions.

“As we continue to remind you, [Monday’s] outsized move is not on its own historically indicative of either a healthy market or an investable low,” DataTrek Research Co-Founder Jessica Rabe wrote in a note.

Rabe’s right, isn’t she? Big moves are the norm these days. Short-term traders who take them as buy or sell signals (without further confirmation) will quickly find themselves in hot water.

Longer-term investors should be concerned, too, as the earnings backdrop weakens, even if momentum shifts bullish heading into the holidays.

“3Q and 4Q earnings should confirm fundamentals remain anchored in resilient labor market and Covid reopening. Equity valuation will likely remain tied to global central bank rhetoric and rates, which is turning incrementally less negative. As such, we see equities primed for upside into year-end on resilient 2H22 earnings, low equity positioning, very negative sentiment and given more reasonable valuation,” explained Dubravko Lakos-Bujas, JPMorgan’s head of global macro research.

“Next year, however, we expect a more challenging earnings backdrop relative to current expectations.”

In other words, Lakos-Bujas is saying to buy the dip.

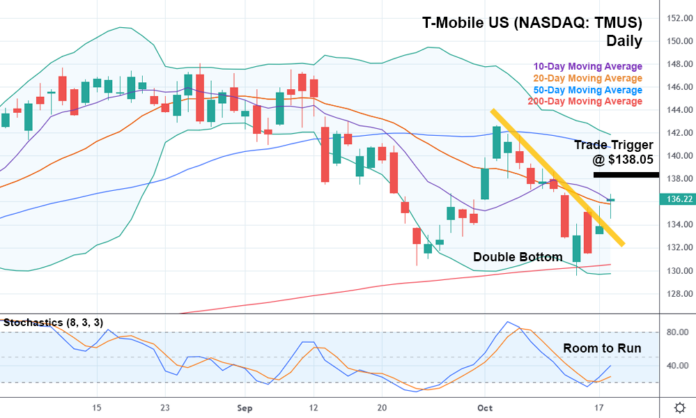

And while that might not make much sense yet for most stocks, T-Mobile US (NASDAQ: TMUS) is looking very “buyable.” TMUS set a double bottom at the 200-day moving average last week before closing above the 10 and 20-day moving averages this afternoon.

TMUS also took out its minor bearish trend (yellow trendline) today. The stochastic indicator suggests the stock has plenty of room to run, too.

For those reasons, it might make sense to take TMUS long with a trade trigger of $138.05, above today’s high, as investors mull over the last few trading sessions.