What a day it’s been.

This morning, President Trump refuted the claims of a Wall Street Journal report from last night, which spelled out the details of a phase one agreement between the U.S. and China.

Then, Chinese officials held a press conference, confirming that a trade deal had been secured.

Finally, Trump took to Twitter, re-confirming the statements from Chinese officials and the fact that the next round of tariffs was canceled.

All in all, it should’ve been a huge session for bulls.

Stocks traded “flat” instead. Investors, unamused by the phase one deal – which didn’t make any significant changes to China’s trade practices – didn’t feel the urge to buy.

And trade war-sensitive stocks took a beating.

Other companies, meanwhile, continued to plod along – unfettered by the background “noise.” Some stocks, for better or for worse, aren’t tied as closely to the general markets.

Today, those stocks started to show renewed promise. Especially the ones that sold-off in recent months.

Take, for example, Uber Technologies (NYSE: UBER), the much-maligned transportation service provider that went public in May of this year.

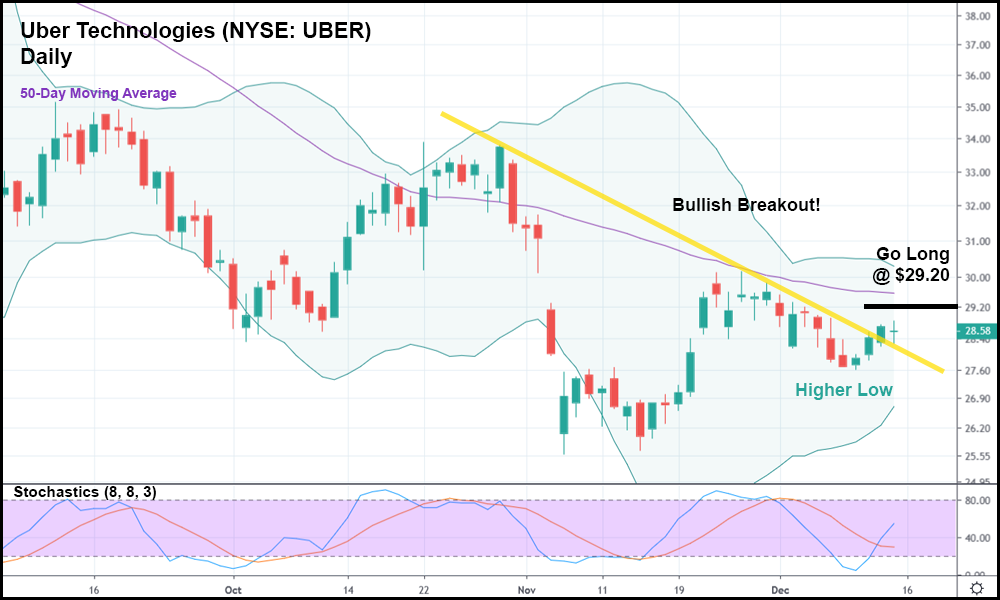

In the daily candlestick chart above, you can see that UBER’s had a bad run. Yes, the stock did rise at points, but long-term, it’s been caught in a downtrend its entire existence.

Since debuting at $42.00 in May, UBER shareholders did some serious selling. Like rats fleeing a sinking ship, bears escaped UBER as soon as it started dropping in late July/early August. It topped out at $47.08 in June, right before plunging 35% over the next two months.

But now, having recovered from its all-time low, UBER is attempting to reverse course. In fact, this week, the stock managed to actually set a higher low – a universal bullish sign.

And in doing so, UBER broke out of its minor bearish trend. With yesterday’s candlestick trading above the last four candle bodies, share prices are finally displaying some upward momentum. The stochastic indicator remains at mid-level as well, suggesting that the stock is neither overbought nor oversold.

Should UBER rise slightly above today’s high, it might make sense to go long at a trigger price of $29.20. Resistance sits close by at $30.00 (the late November high), and if UBER can move past that price point, a rally could be waiting on the other side.

Whether or not that happens though is contingent upon UBER continuing to rise – something that looks likely, regardless of whether the trade deal influences the market further.