2019’s entering the home stretch, and investors are as confused as ever. President Trump secured a partial trade deal on Friday, but come Monday morning, China needed more time to think about it.

The market stalled.

Then, on Tuesday (yesterday), J.P. Morgan, UnitedHealth, and Johnson & Johnson posted big-time earnings, beating out analyst estimates. Investors saw it as a sign of strength in both the banks and the economy.

The market rallied.

This morning, the Commerce Department revealed that U.S. retail sales decreased by 0.3% for the month of September. That’s the first retail contraction in seven months.

The market stalled yet again, even in the face of impressive earnings.

And as usual, investors were left with more questions than answers. Is the economy really as strong as earnings suggest? Are consumers just growing a little more pennywise before the holidays?

Or is the U.S. en route to an economic slowdown?

Most importantly:

Is the partial trade deal going to end the trade war (eventually)?

We’ll discover answers to at least some of those questions (not all) over the next few weeks, but for now, stocks seem reluctant to move in either direction.

And like always, when uncertainty grips the market, investors tend to get skittish, creating trading opportunities in the process. This morning, a software stock called Microstrategy Inc. (NASDAQ: MSTR), generated a “clean” setup that looks, on paper, about as good as it gets.

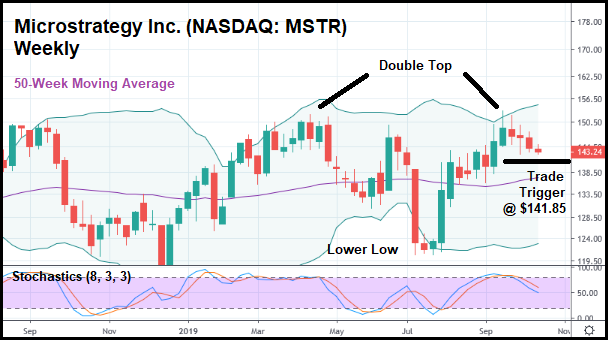

In the weekly candlestick chart above, you can see that MSTR has formed a classic “double top” – a formation that often precedes a trend reversal. After hitting the upper Bollinger Band (BB), the stock bounced back downwards. It’s been a bit of a slow-mover, but if prices descend much further, a rapid collapse could easily occur.

The current week’s low sits around the low from two weeks ago, which serves as a level of key support.

If MSTR falls below that support by a significant amount (to $141.85), going short might make sense at the trade trigger displayed in the chart.

Best of all, MSTR has plenty of room to fall. The next level of strong support lies at $135.00, and below that, $122.00, right near the lower BB.

Should MSTR drop that far, bears would be looking at a gain of around 15% from the entry point of $141.85. An appropriately priced and dated option (with sufficient open interest) could easily return ten times that amount.

So, over the next week, keep an eye on MSTR. If prices slump, the stock could crater in a hurry as it blows past support levels propping up shares. Long-term investors will likely feel frustrated by the movement (if it happens) while short-term traders happily collect their winnings.

Even if the general market ends up going higher. Because if there’s one thing that MSTR has shown us over the last year, it’s that it moves independent of the indexes.

And that, coupled with the double top, makes this a very attractive short setup in a market that seems likely to rise.