After getting smacked for three sessions in a row, the market recovered today, leaping upwards in spite of some less-than-ideal news. Early estimates are predicting a payroll growth miss for this Friday’s jobs report, heaping more pressure upon an already stressed out market.

President Trump did his best to right the ship this morning by saying that talks between the U.S. and China are going very well, just one day after he made it seem like a trade deal wouldn’t happen until after the 2020 election.

Trump also canceled his typical post-NATO summit press conference, leaving some analysts scratching their heads.

In the end, though, it didn’t seem to matter – the market was intent on bouncing back today, and it did just that. After opening higher in the morning, it finished out the session strong, rising through the end of trading.

And with the surging tides, plenty of stocks were lifted in the process. Some, of course, made out better than others, as sold-off sectors got a welcome “shot in the arm.”

American automakers, in particular, were pleased to see an uptick in share prices after getting crushed over the last month. And, as luck would have it, one of them is in position to make a big move, regardless of whether the market continues falling or not.

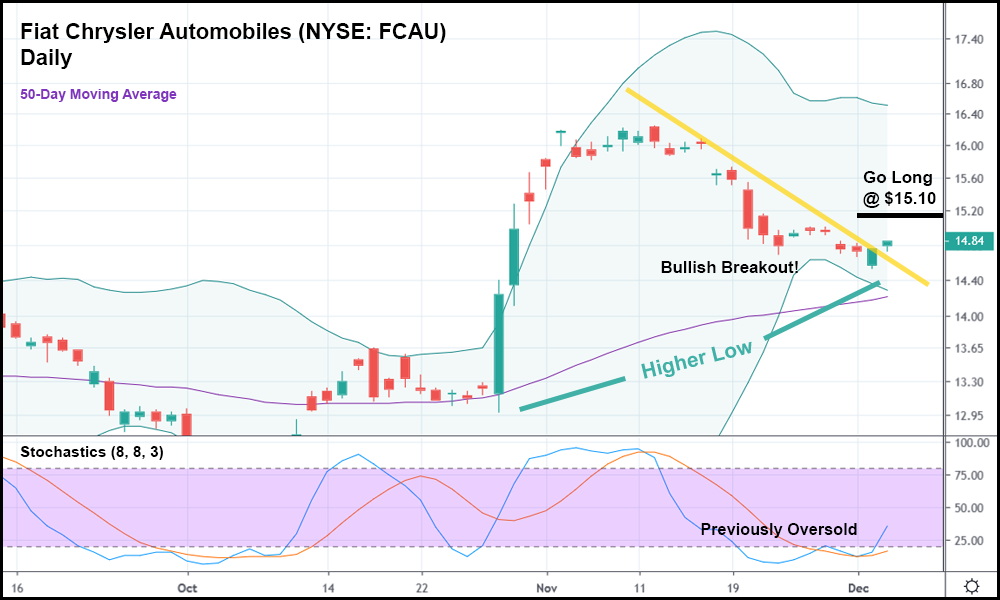

In the daily candlestick chart above, you can see that Fiat Chrysler (NYSE: FCAU) is finally making another run at its early November high. Share prices rocketed a little over a month ago before running out of steam. After reaching so far above the upper Bollinger Band (BB), it’s not surprising to see the stock lose momentum so quickly.

But FCAU bulls didn’t expect the next leg-up to take so long to form. Today, however, it appears as though their patience will soon pay off. With this morning’s blast, FCAU jumped above the trendline (tracing the recent standout highs) and managed to close there. The most recent daily candlestick is trading above the last three candle bodies, and the 50-day moving average is sloping upward.

We even have a new higher low relative to the low from late October.

In other words, this is a great bullish setup, and it might make sense to go long should FCAU rise above the current candlestick’s high by a sufficient amount (to $15.10). An appropriately priced and dated option, should FCAU set a higher high in the near future, would return potentially massive gains.

Best of all, FCAU’s kind of “done its own thing,” over the last few weeks, independent of the general market – meaning we don’t need a prolonged recovery for this stock to truly take off.